Good afternoon! Welcome to this weekend edition of The Closer, where we look at the world through the lens of dealmaking. Our motto is “deals change the world”, and the just-announced Salesforce–Informatica tie-up is an exciting way to see that play out (and a great follow-up to our capsule analysis of the big Databricks deal a few weeks back).

Within a couple of years, Marc Benioff may have transformed Salesforce into an AI data powerhouse – owning not just the apps you use, but the data plumbing and intelligence underneath them.

Hope you enjoy, and please get in touch with ideas on how to make The Closer even better. You can reach me here.

-- Bradley

Stacking the Deck: Salesforce’s $8B Bet on Informatica and the AI Data Stack

Key Players & Deal Terms

- Marc Benioff & Salesforce: Visionary CEO reasserting his dealmaking mojo. After a year of activist pressure, Benioff is back on offense – aiming to dominate enterprise AI by owning its data backbone.

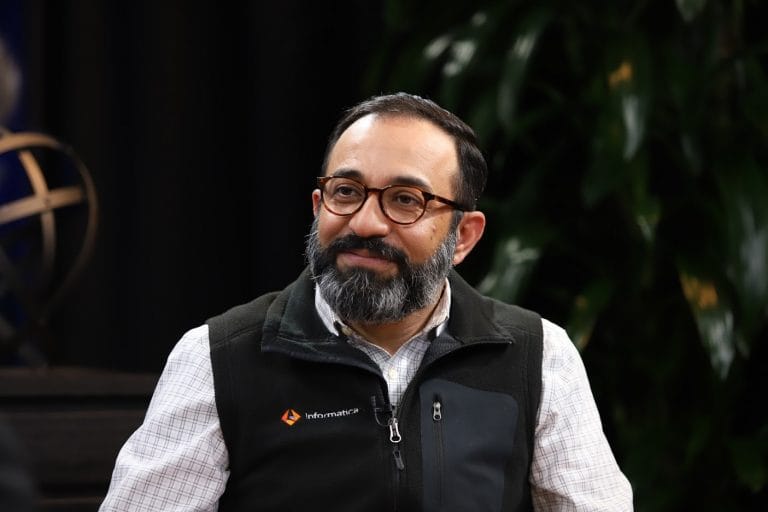

- Informatica & Amit Walia: Longtime leader in data integration and management. CEO Amit Walia navigated Informatica’s cloud transition and now lands his 30-year-old company in Salesforce’s arms.

- Permira & CPPIB: Private equity sellers (and major shareholders) who first took Informatica private in 2015 for $5.3B are poised for a solid win. An exit at $25/share (≈30% premium) delivers a payoff on their modernization bet.

- $8B All-Cash: Deal value (net of Salesforce’s existing stake) with Informatica shareholders to receive $25 per share in cash. It’s Salesforce’s biggest buy since Slack, but “methodical” – struck after Informatica’s valuation cooled from its 2021 peak.

Strategic Stakes

This deal is all about owning the data plumbing for the AI era. Salesforce gains a trusted, enterprise-grade data foundation for its AI ambitions, plugging Informatica’s integration and governance expertise directly into its platform. In one move, Benioff can offer customers an end-to-end “AI + data” stack: from ingesting and cataloguing data, to unifying it in Salesforce’s Data Cloud, analyzing it in Tableau, and now deploying AI agents on top.

It’s a defensive play, too – keeping those capabilities out of the hands of rivals. With Informatica’s 5,000+ enterprise customers and $1.6B in ARR joining the fold, Salesforce significantly broadens its data reach and credibility in AI. The message is clear: in the AI gold rush, Salesforce doesn’t just want to sell shovels – it wants to own the gold mine.

Winners/Losers

Winners: Salesforce (supercharges its AI platform with best-in-class data management), Informatica’s investors (PE backers cash out after a 2× journey), and enterprise customers (could benefit from more seamless data-to-AI solutions). Also, Marc Benioff – who regains his swagger as an acquirer with a strategic coup.

Losers: Independent data-integration vendors (Talend/Qlik, cloud ETL startups) now face a goliath offering one-stop data + AI solutions. Snowflake might feel a pinch too – a friendly partner today, but tomorrow Salesforce’s unified “data + AI” platform may encroach on Snowflake’s turf. And perhaps Oracle and SAP, whose database and integration strongholds are challenged by Salesforce’s expanding data stack. Lastly, any activists who urged caution on big deals: Benioff just emphatically ignored them.

"The playing field is poised to become a lot more competitive, and businesses that don’t deploy AI and data to help them innovate in everything they do will be at a disadvantage." – Salesforce

Get the full deep dive after the break. Don't forget to check out our free tool: We built a custom GPT called The Closer: Negotiation Wizard—a tactical AI advisor for founders, sales pros, and dealmakers. It draws from 1,000+ curated sources across psychology, business, and cultural strategy. It’s not just ChatGPT—it’s a high-leverage negotiation assistant with tools, playbooks, scripts, and decision frameworks.

Key Players in the Enterprise Data Stack

Salesforce

Core: CRM titan turned AI cloud platform, now armed with integration (MuleSoft), analytics (Tableau), and data management (Informatica) to offer an end-to-end data stack.

AI: Infuses AI across products (Einstein GPT, Agentforce) using unified customer data – aiming to make enterprise AI pervasive and responsible.

Latest Move: Snapped up Informatica for $8B to ensure its AI agents have the clean, contextual data they need at scale.

Snowflake

Core: Cloud data warehouse leader enabling companies to store and share huge volumes of data seamlessly.

AI: Expanding into data science and AI apps by hosting models and integrating Python, while partnering to bring AI directly to the data.

Latest Move: Acquired search startup Neeva to add AI-driven query and retrieval capabilities to its Data Cloud, signaling a push beyond warehousing into AI-centric data services.

Databricks

Core: The "lakehouse" platform blending data lake flexibility with data warehouse reliability – beloved by data engineers and data scientists alike.

AI: Deeply rooted in AI with its ML frameworks; offers ready-made tools for training and deploying enterprise ML and LLMs on massive datasets.

Latest Move: Bought MosaicML for $1.3B to bolster its generative AI chops, and even scooped up database startup Neon (~$1B) to optimize for AI-native.

Oracle

Core: The legacy database giant that still runs a huge chunk of the world's data. Now a cloud provider (OCI) with a full suite of databases and integration tools (GoldenGate, etc.).

AI: Adding AI services (AI@Oracle) and partnering with startups to keep its database offerings relevant; touts that its cloud databases can directly run AI models on data.

Latest Move: Leaning into strategic partnerships – e.g. hosting Microsoft's AI services in OCI – and pitching its autonomous database as a foundation for enterprise AI workloads.

Palantir

Core: Data analytics and operations platform known for integrating siloed data for decision-making (with roots in govt intelligence). Essentially, it sits on top of orgs' data to find patterns and power decisions.

AI: Pivoting hard into AI with its new AIP (AI Platform), which lets clients layer LLMs on their private data with control. Palantir positions itself as the glue between raw data and AI insights for enterprises.

Latest Move: Riding a wave of interest as companies seek secure AI solutions – Palantir's focus on secure, governed data integration now doubles as its AI selling point, and it's reportedly in talks to invest in or acquire smaller AI players to augment its platform.

Next Catalysts

Watch for regulatory approvals (the combo is complementary, so clearance should be smooth by year-end). Product roadmap at Dreamforce 2025 – Salesforce will likely showcase an “Agentforce” AI assistant supercharged by Informatica’s data lineage and MDM. Integration won’t be trivial, but Salesforce says its approach to M&A is “methodical, patient, and decisive”– so expect a measured roll-out of Informatica features across the platform.

Also keep an eye on competitor responses: will others counter? Cloud giants like Microsoft or Google might deepen their own data tooling, and database players (Oracle, IBM) could eye similar acquisitions of data catalog or governance specialists. The next wave of consolidation in the AI data stack may just be beginning.

Deep Dive

Informatica isn’t some shiny AI startup; it’s a 30-year-old veteran of the enterprise data wars. When it was founded in 1993, “big data” meant Oracle databases and ETL jobs, and Informatica’s tools became the go-to for shuttling data between systems. After an up-and-down ride – including two IPOs and a private equity makeover – Informatica has re-emerged as a leader in cloud data management. Now, in 2025’s AI frenzy, that hard-earned expertise is suddenly sexy again. Why? Because garbage in, garbage out: Fancy AI algorithms are useless if they’re fed dirty, siloed, or ungoverned data. Informatica’s software tackles exactly that, ensuring data is clean, connected, and credible – the unsung hero behind quality AI predictions.

Salesforce’s bet on Informatica underscores a broader truth: the AI revolution is also a data revolution. Companies have scrambled to adopt AI models, but many struggle with the data foundations. (As Salesforce’s own AI CEO, Clara Shih, noted, “there’s no question we are in an AI and data revolution… But it’s not as simple as taking all of your data and training a model with it” – issues like security, permissions, and provenance matter.) By scooping up Informatica, Salesforce is saying it wants to solve those data problems for its customers – to be the one-stop shop for harnessing AI safely and at scale. It’s a play to make Salesforce indispensable in the AI age: if your CRM, marketing, and analytics all run on Salesforce, and now your data integration and governance do too, why would you go anywhere else for AI?

There’s also an element of redemption here. Just over a year ago, Benioff was on the defensive – Salesforce’s growth was slowing, activists were circling, and he had to cut costs and dial back the acquisition sprees. He did so, and Salesforce’s profits and stock price rebounded. Now, armed with renewed investor confidence, Benioff is seizing the moment to play offense in a domain (AI) that’s reshaping enterprise tech. Informatica wasn’t cheap, but compared to Salesforce’s $27B Slack buy, this looks like a surgically targeted strike: a mature asset at a fair (not frothy) price, aimed squarely at a $150+ billion data market opportunity. As one VC quipped, Salesforce “paid $8B for AI infrastructure credibility, thousands of enterprise relationships, and a data governance moat” – in other words, it bought itself a huge strategic upgrade.

Big picture: this acquisition signals that the lines between software and data platforms are blurring. CRM isn’t just about customer records anymore; it’s about the AI and analytics that live on top of those records, which in turn depend on pulling data from everywhere. We’re seeing an arms race to build the full-stack AI platform: Salesforce now has apps, integration, analytics, and data management; others like Microsoft, Oracle, and SAP are layering AI on their clouds and ERPs; upstarts like Databricks (see here) and Snowflake are expanding from data into apps and AI. For customers, the promise is seamless AI that actually works with their data. The risk is locking into one ecosystem – but if that ecosystem delivers results (and ROI), many will happily sign on.

In the short term, success will hinge on execution: Salesforce must integrate Informatica’s tech and talent without disruption. Culturally, a large, 30-year-old data plumber joining a high-flying cloud CRM could pose challenges. But if Benioff can keep his team focused (perhaps aided by that Herb Cohen-esque detachment – not getting emotionally distracted by naysayers or integration noise), Salesforce stands to gain a unique edge. Long term, this deal could redefine the company: Salesforce would no longer just be the king of CRM – it could become an AI data platform that rivals the likes of Microsoft Azure or IBM in enterprise AI offerings. That’s deals changing the world in action. By reshuffling who owns the “boring” but crucial parts of the tech stack, this merger might accelerate how quickly AI actually delivers value in the enterprise. And it sends a message: in the age of AI, the boring stuff matters. The winners will be those who master the data pipelines, not just the algorithms.

In sum, Salesforce’s $8B gambit is a bold wager that controlling the entire data journey – from raw database to AI-driven insight – is the key to leading the next era of enterprise tech. If it pays off, Salesforce will have turned itself into an indispensable AI partner for business, with Benioff cementing his comeback by proving that sometimes the best way to predict the future is to buy it.

Chart of the Week

CHART OF THE WEEK

Recent AI/Data Platform M&A and Funding (2023–2025)

Key Insight: Data giants are racing to acquire AI capabilities. Salesforce's $8B Informatica deal shows how critical clean data infrastructure has become for enterprise AI ambitions.

Takeaway: The race to control the AI data stack is on, from giant strategic bets to niche talent grabs. Big Tech and startups alike are spending serious money to secure the “fuel” for AI – enterprise data.

Other Major Deals This Week

- NYC Pensions Sell $5B of PE Stakes to Blackstone: New York City’s pension system is offloading a $5 billion private-equity portfolio to Blackstone – reportedly the largest PE secondaries sale ever. The move allows NYC to streamline its relationships (125+ fund stakes sold) and rebalance its investments. Axios 🔗

- E.l.f. Beauty Buys Rhode for $1B: In a landmark beauty deal, e.l.f. is acquiring Hailey Bieber’s skincare brand Rhode for $1 billion. The Gen-Z focused line (launched 2022) brings e.l.f. a viral, fast-growing skincare platform, as big cosmetics continue snapping up celebrity brands. 🔗

- Leidos Acquires Kudu Dynamics: Defense tech giant Leidos closed a ~$300M all-cash buyout of Kudu Dynamics, a Virginia-based cyber warfare firm specializing in AI-driven hacking tools. The deal bolsters Leidos’s offensive cyber capabilities (think AI-assisted cyber-ops) for U.S. defense and intel clients. 🔗

96-Hour Catalyst Countdown

Why It Matters: Global policymakers tackle AI governance – any new frameworks could foreshadow regulation.

Why It Matters: The Fed's regional economic report drops – anecdata on labor markets and credit conditions may hint at policy tone ahead of the June FOMC.

Why It Matters: Last day for feedback on a major merger's S-4 filing – a procedural step, but watch if any investor pushback surfaces in comments.

Why It Matters: The end-of-quarter rush kicks off – historically, some of the year's biggest deals land in the final days of Q2. Keep your phone on.

Playbook: The Strike Zone Is Narrow, but When It’s There—Swing Hard

Great negotiators don’t move constantly—they move correctly. One of the least understood skills in dealmaking is the ability to wait without drifting, to hold conviction while the world misreads your stillness as indecision.

That’s what made Salesforce’s Informatica move so sharp. Benioff passed on a bidding war last year when Informatica was trading high and buyer appetite was frothy. Fast-forward: the market cooled, the asset was still strong, and he struck at a cleaner valuation, with less competition, and better terms. He didn’t freeze—he coiled.

This wasn’t just patience. It was targeted inaction—letting conditions mature until the risk/reward flipped asymmetrically in his favor.

We forget: most legendary moves look easy in hindsight because the hard part—the decision not to act prematurely—left no visible trail.

Takeaway: The best deals often come from holding fire until the window is narrow, and then swinging with full force. Don’t chase noise. Train for timing. Wait with intent. And when the strike zone finally appears—don’t blink.

“In trading, the money is made by sitting, not trading.” – Jesse Livermore

In deals, sometimes it's made by waiting, not chasing.

If you’ve read this far, we want to hear from you! We hope The Closer is becoming an essential part of your week – an insider guide to the deals changing our world. Ideas, feedback, or just want to chat? Please get in touch or even schedule a meeting with me here. Until next time!