Welcome to Backchannel. This is the weekend briefing for subscribers of The Closer, where we decode power plays in deal-making, business, and influence.

This week: Union Pacific’s $85 billion bid to absorb Norfolk Southern—and stitch America together end-to-end—gets the full narrative autopsy. We map the tracks, cost the synergies, and ask whether Jim Vena’s “21st-century golden spike” is nation-building or monopoly cosplay.

Housekeeping: Both Backchannel and the Monday Jump-Start are now subscriber-only. You’ve probably spotted our new Negotiation Nuggets—bite-sized tactical intel dropping Tues-Thurs as part of our mission to deliver the most unflinching, high-signal analysis of global deal-flow.

If you’re already a paid subscriber: thank you for raising the bar on independent intelligence. If not, now’s the moment.

Want more of something? Hit reply—I read every note.

— Bradley

Top Reads This Week

Google’s Android walled-garden cracks

A unanimous 9th Circuit ruling forces Google to let rival app stores and third-party billing into Play, cementing Epic Games’ antitrust win. Platform power is now officially up for grabs—watch regulators (and Apple) scramble to adjust. Reuters

Brookfield’s £2.4 bn pension power-grab

Brookfield Wealth Solutions is buying UK annuity specialist Just Group at a 75 % premium, vaulting itself into Britain’s booming pension-risk-transfer market. Private-equity money is chasing long-tail insurance cashflows—expect more roll-ups in the life sector. Reuters

Powell holds fire, markets re-price

The Fed kept rates at 4.25 – 4.50 % and gave zero hints of a September cut, slicing the odds of near-term easing in half. Higher-for-longer now underwrites deal models, funding costs and EM capital flows. Reuters

Twenty-minute tech glitch grounds Britain

A software fault at NATS froze UK airspace, cancelled 150 + flights and put CEO Martin Rolfe in the political crosshairs. Critical-infrastructure resilience is only as good as its weakest line of code—reputational risk now travels at jet speed. The Independent

QuantumScape × VW double down on solid-state

An expanded deal gives PowerCo up to $131 m more skin in the game and rights to produce 5 GWh of QSE-5 cells annually. Milestone-tied cash shows automotive electrification timelines are tightening—and venture tech must match OEM urgency. QuantumScape

Union Pacific’s Transcontinental Gambit

Forging a $85 Billion Rail Empire

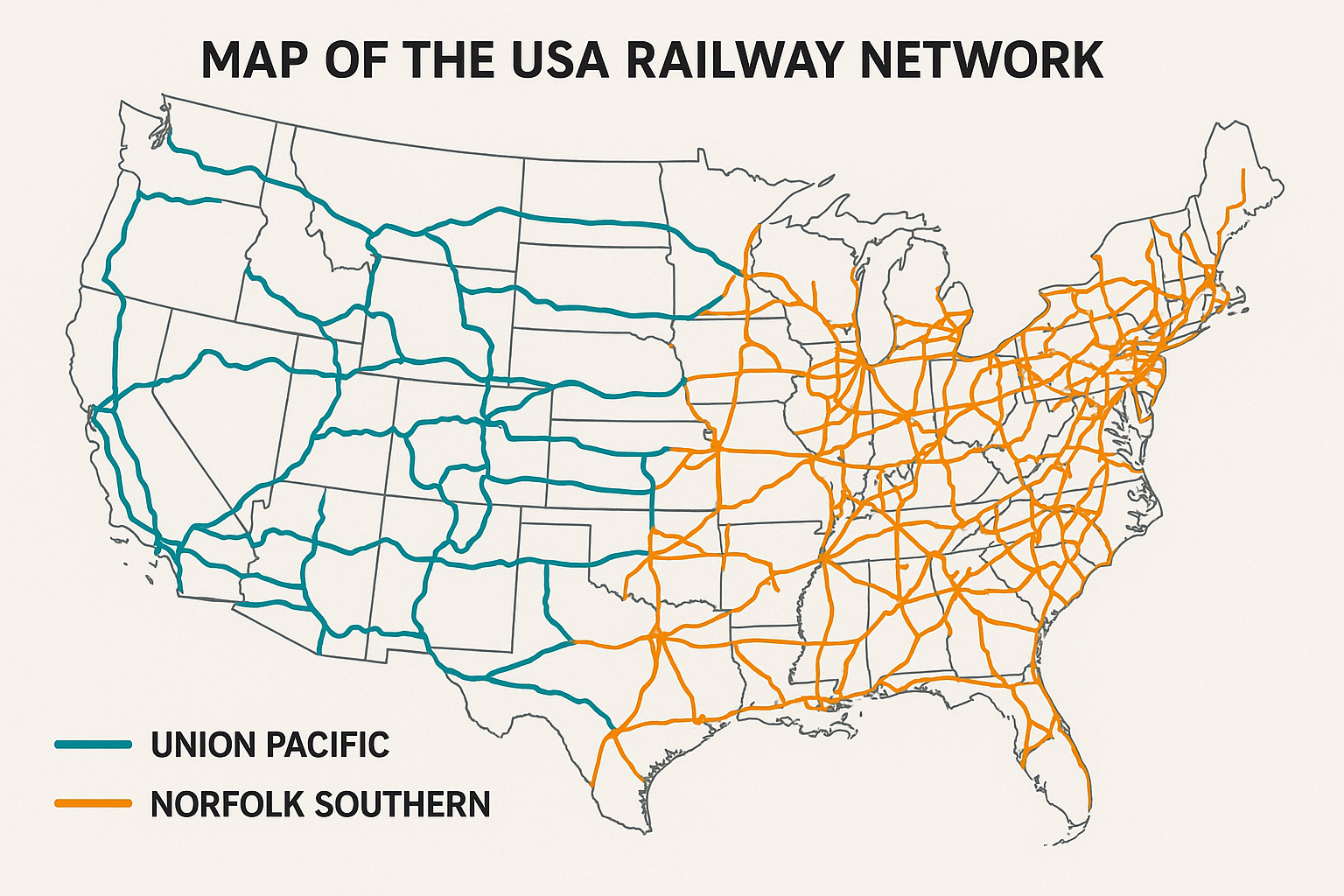

Union Pacific’s audacious proposal to acquire Norfolk Southern for $85 billion aims to create the first coast-to-coast U.S. freight railroad, linking Atlantic and Pacific markets under one network. It’s a historic play with echoes of the 1869 Golden Spike era – except this time a single company would control the transcontinental route. The merger promises to “transform the U.S. supply chain, unleash the industrial strength of American manufacturing, and create new sources of economic growth." But it also raises tough questions about competition, jobs, and safety that regulators, workers, shippers, and politicians are already grappling with.

TRANSCOASTAL RAIL BET

Union Pacific’s Vision: A National Railroad for a Connected America

THE NEW COAST-TO-COAST GRID

50,000 mi

Track across 43 states

100+

Ports linked coast-to-coast

“Imagine steel Pittsburgh→Colton or tomato paste Huron→Fremont with no hand-offs.”

— UP CEO Jim Vena

THE MONEY & SYNERGIES

$85 bn

Transaction value

$250 bn

Combined EV

$2.75 bn

Annual synergies

27%

Merged-rail stake for NS holders

THE BOTTOM LINE

Union Pacific frames the tie-up as more than an $85 bn deal—it’s nation-building on rails: one carrier, coast-to-coast reach, faster freight, bigger jobs engine. Whether regulators buy the “public-interest” story will decide if the golden-spike dream finally goes corporate.

Jim Vena (left) and Mark George (right)

The Dealmakers: Jim Vena and Mark George at the Helm

Jim Vena, Union Pacific’s CEO, is the driving force behind the merger. A 40+ year railroader, Vena literally “knows railroading firsthand” – he started as a Canadian National track laborer and worked his way up through roles like brakeman, engineer, and superintendent. This hands-on background forged a reputation as a hard-nosed operations guru. Vena joined Union Pacific’s executive ranks in 2019 to implement precision scheduling and efficiency measures, and after a brief retirement, was brought back as CEO in August 2023 amid investor pressure to improve performance. By all accounts, he delivered – under his watch the railroad’s service metrics rebounded to some of the best in its history. This operational credibility is now central to Vena’s pitch for the merger: he argues the combined network can be integrated smoothly and run safely, avoiding the service meltdowns that plagued past rail megamergers. “We’re committed to making sure that doesn’t happen in this case,” Norfolk Southern’s CEO has said, noting they will spend two years planning integration to ensure a smooth transition.

Opposite Vena stands Mark George, Norfolk Southern’s chief executive, who provides a contrasting but complementary profile. George came to railroading from the finance side: he served as NS’s Chief Financial Officer from 2019 until abruptly being promoted to CEO in September 2024 after his predecessor was ousted in the wake of the East Palestine derailment crisis. With a background at industrial giants (he was CFO at Otis Elevator and Carrier Corp. before joining NS), George is seen as a strategic and numbers-driven leader. NS itself credits him with bringing a “business partnership mindset” to the company, sharpening focus on productivity and cost control. In taking the helm after a safety scandal, George emphasized rebuilding trust – he spoke of “creating a safe and satisfying workplace” while still “delivering enhanced value for…shareholders.” This dual focus on safety culture and efficiency set the stage for NS to enter a merger from a “position of strength”, as George put it.

A Coast-to-Coast Railroad: Operational Change and Historic Symbolism

If approved, Union Pacific’s acquisition of Norfolk Southern would cement a truly transcontinental railroad for the first time in U.S. history. America’s coasts were first linked by rail in 1869 at Promontory Summit, Utah, but that was a meeting of two companies (UP and Central Pacific), not a single system. Ever since, no one railroad has outright owned an unbroken route from the Atlantic to the Pacific – the country instead developed with Eastern and Western rail giants meeting at interchange points. This merger would change that. Operationally, the impact would be profound: a shipment could travel from California ports all the way to New York harbor or Florida on one network, under one management, without changing hands. The result? Potentially faster deliveries and less risk of delay or mishandling, since “removing car handoffs and interchanges…eliminates several days [of transit time]” on long hauls. This could particularly benefit time-sensitive cargo like parcel shipments, autos, or perishable agricultural products that suffer from dwell time at interchange yards.

Union Pacific itself is leaning into the historical narrative – after all, UP was born from the Pacific Railway Act signed by Lincoln in 1862, tasked with building westward to meet the Central Pacific. Completing that mission in a modern form provides a storyline of continuity. The golden spike moment of 1869 was about uniting the nation; in 2025, executives claim uniting the railroads will “deliver for the whole American economy…today and into the future.” There’s also a robber-baron era echo here: in the late 19th century, tycoons like Jay Gould and E.H. Harriman dreamed of controlling transcontinental routes. Harriman, notably, at one point owned the UP and Southern Pacific and aspired to link them with an eastern line, though antitrust pressures in the early 1900s limited those ambitions. In 1906, Harriman’s attempt to acquire control of Northern Pacific (which would have extended his empire to Chicago) was challenged by the government. In many ways, the regulatory regime for most of the 20th century prevented coast-to-coast mergers explicitly to avoid monopolies. Not until the industry deregulation of the 1980s and 1990s did railroads consolidate regionally (East vs. West), but even then regulators drew a hard line against transcon mergers after some near-disasters.

A key historical reference point is the failed merger wave of the late 1990s. In 1999, rival CEOs attempted what we’re seeing now: BNSF and Canadian National announced a merger that would have created a continent-spanning railroad from the Pacific, across the U.S., into Canada. That proposal so alarmed regulators that the STB imposed a moratorium on all major rail mergers to rethink the rules. Ultimately, new merger guidelines were issued in 2001 setting a “public interest” bar and requiring mergers to enhance competition (not just be neutral) – a very high hurdle. Those guidelines effectively froze mega-deals for two decades. Only in 2022-2023 did the STB finally approve a big deal under the new rules: Canadian Pacific’s $31 billion acquisition of Kansas City Southern, creating CPKC. The CPKC case is an important precedent for Union Pacific’s bid. It was the first major railroad merger in the U.S. in 20+ years, and regulators cleared it, but not without extensive analysis and conditions. STB noted that CP and KCS were the two smallest Class I railroads and had minimal overlap – their combination was seen as pro-competitive for North American trade (connecting Canada, U.S., Mexico). Even so, the approval came with stringent conditions: keeping gateways open for competitors, periodic oversight reports, and assurances on labor and service during integration.

AUTOMATE

THE AUDIT

=

COST ↓ 96%

How Crediclub’s “Watcher” bot vaporised overhead

Between Dec 2024 – Jul 2025 Mexican micro-lender Crediclub rolled out an Azure/GPT agent that records branch meetings, transcribes them, scores each against a 27-point compliance rubric, and drafts the fix-email. Audit spend crashed from $40.6 k to $1.6 k a month (-96 %) and review capacity jumped from 20 meetings /day to 150 per hour, freeing ~1,600 customer-facing hours daily.

Closer Tactic #43 • Operational AI

The Nugget:

Gen-AI wins biggest where no one’s looking: dull, rule-heavy workflows that bleed cash. Let bots grade the meeting—humans fix the exception.

How to deploy:

- Capture → Transcribe. Auto-record Zoom/Teams; drop text into a vector DB.

- RAG prompt-chain. Feed transcript + audit rubric into GPT-4; return a 0-100 score & flagged lines.

- Human-in-loop send. Compliance lead edits & fires off the corrective-action email—training the next run.

- Show the money weekly. Dashboard hours freed + $ saved to fund sprint #2.

Takeaway:

First you prove AI can delete overhead nobody loves—then you point it at revenue.

🟠 Building your own AI to reduce costs? Hit reply—top story gets a Closer mug and we'll share it in next week's edition and social media.

If you’ve read this far, we want to hear from you! We hope The Backchannel is becoming an essential part of your week – an insider guide to the deals that are changing our world. Ideas, feedback, or just want to chat? Please get in touch. Until next time, keep making moves and thinking outside the box. Deals change the world – and so can you.