Good morning — you’re reading The Closer, the 10-minute cheat-sheet that turns big-league deals and business into stories you can understand.

By the time your coffee cools you’ll know why Chevron's acquisition of Hess has geopolitical ramifications, and a 30% tariff timer could all rewrite markets before Friday.

What’s making waves:

- Trump’s blanket tariffs on EU & Mexico

- Fed decision + core PCE inflation check

- Apple’s “Apple Intelligence” earnings test

- Rumblings of GPT-5 and the GPU scramble

Your tactical edge: a science-backed move — “camera on + 3-bullet recap” — shown to cut cross-border deal misfires by 30%.

-- Bradley

Monday Smart-Start

21 July 2025

Numbers and talking points to look like the prepared one at 9 a.m.

GLOBAL INDICES

COMMODITIES & CURRENCIES

*Week-to-date moves as of Friday close. Source: Market data providers

Invite your friends to subscribe to The Closer!

Surveillance — Rapid-fire intel you won’t find in the week-ahead calendar

- Model-mania watch

Dev channels buzzing that GPT-5 could land “within months” (or days) after Sam Altman’s, per Bloomberg and lots of online speculation. Hardware names (NVDA, AVGO) pricing in a pre-launch GPU scramble. Bloomberg - Trade brinkmanship

President Trump locked in 30 % blanket tariffs on EU & Mexico imports starting 1 Aug. Corporate ops teams now have 17 days to rejig supply chains or swallow fatter landed costs. Reuters - Inflation litmus test

After June CPI surprised at +0.3 % m/m, the next read is core PCE on Thu 31 Jul. Consensus sees +0.3 %; a softer print would keep September-rate-cut chatter alive. Reuters & Bureau of Economic Analysis - Bankers’ scoreboard

JPMorgan, Citi, Wells Fargo & BlackRock posted Q2 earnings last Tue; all trimmed loan-loss reserves, signalling more headroom for Q3 LBO leverage even as Dimon stays gloomy. Reuters & JPMorgan Chase - Deal pulse

Santander’s £2.65 bn swoop on TSB resets the UK retail-bank chessboard, while BBVA’s €13 bn hostile play for Sabadell just hit fresh EU regulatory turbulence. Reuters & Reuters

Week-Ahead Turning Points

July 28 – August 3, 2025

Interest-Rate Path

Fed decision — First full Fed meeting since June growth scare. Any hint of a September cut would ripple through mortgage rates and global carry trades.

Wed 30 Jul, 2 pm ET • Federal Reserve

Inflation Reality Check

Core PCE release — Markets need confirmation that tariffs won't reignite prices. A soft read keeps "cut" talk alive; a hot print does the opposite.

Thu 31 Jul, 8:30 am ET • Bureau of Economic Analysis

Trade Wildcard

30% tariffs on EU & Mexico — If last-minute talks fail, new duties hit ~$400 bn in goods starting midnight Fri—raising costs for autos, machinery, and food. Supply-chain desks have 17 days to reroute.

Fri 1 Aug, 12:00 am ET • Reuters

Tech Bellwether

Apple earnings — Investors want proof that Vision Pro and "Apple Intelligence" can restart growth. Apple's tone often sets the mood for the whole Nasdaq.

Thu 31 Jul, after-close • Apple Investor Relations

AI Rulebook

EU AI Act goes live — First global law that binds general-purpose models. Compliance posts from OpenAI, Google, Meta will signal how tough enforcement could be.

Sat 2 Aug, EU • Nelson Mullins Riley & Scarborough LLP

Energy Supply Lever

OPEC+ ministerial — A cut would tighten Brent into peak driving season; a hold keeps crude near $79. Oil shapes headline inflation—and thus central-bank room to cut.

Sun 3 Aug, Vienna • OPEC

AI Hype Cycle

GPT-5 chatter — Sam Altman's "few-months" tease has chip traders front-loading GPU orders. Any concrete roadmap could reprice Nvidia, Broadcom, cloud majors.

Ongoing—watch press leaks • YouTube

THE WEEK'S STAKES

Three inflection points converge: Fed signals, tariff deadlines, and AI regulation. Each could reshape deal calculus through Q4.

Chevron’s $55 billion Hess win: the last great land-grab for black gold?

On 18 July 2025, Chevron finally sealed its $55 billion, all-stock takeover of Hess after a bruising nine-month legal tussle with Exxon and CNOOC. The decisive arbitration ruling unlocked the deal—and with it, boardroom legend John Hess now heads to Chevron’s board.

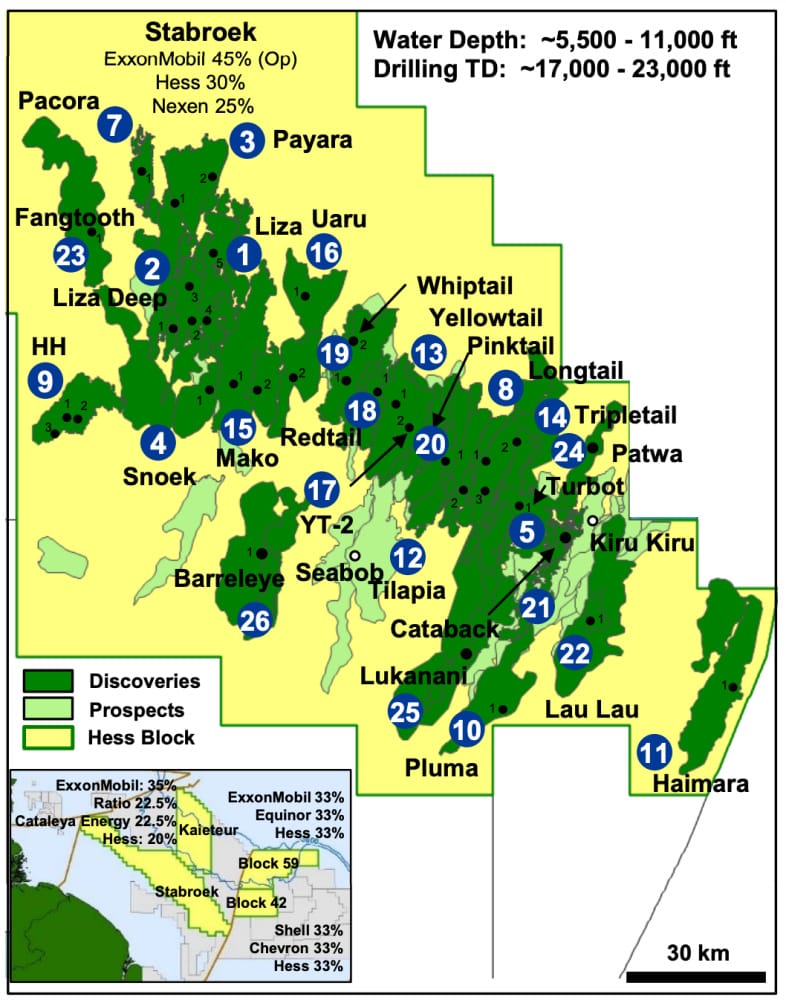

What Chevron really bought wasn’t a brand-name peer—it was access to Guyana’s Stabroek Block, the biggest oil discovery of the century: 11 billion barrels of recoverable reserves that should keep production climbing well into the 2030s. Securing those barrels answers Mike Wirth’s nagging problem: how to replenish a reserve base that had slipped to a decade-low while shareholders still demand juicy dividends.

The numbers look seductive. Chevron forecasts $1 billion in annual cost synergies by year-end 2025 and expects the Hess assets to be cash-flow accretive almost immediately. Fold in Bakken shale acreage, Gulf of Mexico tie-backs, and a swap of Hess shares for roughly 301 million Chevron shares, and the super-major gains scale without adding fresh debt. On paper, the engineering is close to perfect.

Yet the deal carries real hair:

- Timing risk. Exxon and China’s CNOOC still operate Stabroek; Chevron is a 30 % partner with little operating control. Production targets—and political goodwill in Georgetown—must hold for the IRR math to work.

- Clock is ticking. Key Kazakhstan contracts expire in 2033, slimming Chevron’s long-term profile if Guyana disappoints.

- Energy-transition optics. While rivals Shell and BP trumpet low-carbon pivots, Chevron has doubled down on crude just as ESG pressure creeps back into the boardroom.

Why Should You Care?

Chevron’s capture of Hess—and with it a 30 % stake in Guyana’s Stabroek Block—is not just big-company theatre; it nudges three levers that steer the world economy: energy prices, trade flows and dollar liquidity.

1 │ A new anti-OPEC barrel

The IEA now flags the United States, Brazil … and Guyana as the only material sources of non-OPEC+ supply growth through 2030. Stabroek alone is expected to pump 1.7 million b/d by 2030, up from ~650 kb/d today. Extra Atlantic barrels dilute OPEC’s pricing power, keeping Brent’s inflation-sensitive “risk premium” in check. Every sustained $10 move in crude shifts global headline CPI by roughly 0.3 pp (informed estimate). If Guyana’s low-cost crude (<$35 breakeven) caps prices during Middle-East flare-ups, central-bank doves everywhere gain breathing space.

2 │ Trade routes are rewiring

Russian flows to Europe have collapsed to 10 % of pre-war levels, leaving refiners scrambling for light, sweet substitutes.Guyanese cargoes filled the gap: Europe absorbed two-thirds of Guyana’s exports in 2024, up 54 % YoY. That reshuffle shortens voyages versus Middle-East grades, trimming freight emissions and tanker rates while tightening Atlantic Basin price correlations. It also embeds a U.S.-aligned supply hub on South America’s doorstep—strategic insurance as Washington weaponises energy sanctions.

3 │ A petro-boom (and its cautionary tale)

Oil turned Guyana from one of South America’s poorest nations into the world’s fastest-growing economy—GDP per capita tripled to $18 k in three years. Revenues climbed to $2.6 bn in 2024, funding a record public-investment spree. The windfall can seed regional demand, new sovereign-wealth capital and infrastructure links—or spark Dutch-disease, governance strains and LNG-style carbon lock-in.

4 │ Capital-cycle signal

By paying five times Hess’s 2018 market cap, Chevron telegraphed that buying reserves is cheaper than exploring. That is a bullish data-point for upstream M&A—and a bearish one for oil-service jobs. If other majors follow, expect fewer, bigger players with tighter supply discipline: stable cash-yield stocks for Wall Street, but thinner competition for governments selling acreage.

5 │ Climate versus cash flow

While BP and Shell trumpet renewables, Chevron is doubling down on high-margin crude. The bet: demand erosion will be slower than policymakers hope, so last-barrel margins stay fat. If that read is right, carbon budgets tighten, not loosen—shifting the mitigation burden onto consumers and policymakers rather than producers.

For deal-makers, the transaction is a case study in “strategic inevitability meets legal brinkmanship.” When core assets become scarce, the premium shifts from price to optionality—Chevron paid up not for current barrels but for the right to steer a decades-long production runway.

CAMERA

ON

=

TRUST ↑

Flip the video, save the deal

A July 2025 MEST Journal study tracking cross-border supplier talks found that teams using video-on calls, then sending a quick written recap, cut coordination costs by 30% and halved post-meeting misunderstandings. Visual cues ≈ faster trust-building.

Closer Tactic #68 • Digital Dealcraft

The Nugget:

Don't hide behind a blank screen. Kick off virtual negotiations with cameras on, then lock decisions in writing before leaving the call. Seeing faces sparks rapport; the recap cements clarity.

How to deploy:

- Lead with video-on for every first meeting—signal openness and read micro-reactions.

- Screen-share key terms live; annotate to confirm mutual understanding.

- Send a 3-bullet recap (< 5 minutes) while energy is high; invite "reply-all" tweaks inside 24 hours.

Takeaway:

Small tech tweaks—camera on, swift recap—translate into real cash and fewer headaches when the pressure's on.

If you love The Closer, you’ll also love Whale Hunting, where the team at Project Brazen explore the hidden world of money and power every week.