Good morning and welcome to the new Monday edition of The Closer. We're going to get the week started with some headlines and quick takes. Then on Fridays we're going to take a step back and examine the bigger picture (and suggest some weekend distractions). Stay tuned on Thursday this week for a special edition of The Closer where we are going to debut a special negotiation and deal-making tool we've been working on. – Bradley

Deal Radar

Mars’ $36B Snack Grab Faces EU Scrutiny

Mars’ $36 billion acquisition of Kellanova (Pringles, Pop-Tarts) is under EU antitrust review, with a decision due 25 June. The deal aims to consolidate top snack brands (M&M’s, Snickers, Pringles), tightening Mars’ grip on the industry. Legal chatter suggests smooth sailing—unless overlap concerns boil over.

Watch For: Surprise concessions or a second-phase review.

The Longer Take: Mars is gobbling up Kellanova (Pringles and Pop-Tarts) for $36 billion. At $83.50 a share (33% above its pre-rumor price), it’s the biggest packaged-food deal since Kraft-Heinz in 2015. Why the sugar rush? Mars wants to bulk up beyond chocolate.

After years of price hikes and shoppers defecting to store brands, it’s betting that more scale means more staying power. “We hope to absorb more costs...and not pass them on,” its CEO promised, pitching the merger as a way to keep prices in check.

Brussels isn’t buying that yet. EU regulators will decide by June 25 whether to bless the deal. On paper the overlap is small (candy vs chips), but grocers fear the combined giant will throw its weight around—dominating shelf space and hiking prices. Snack bars are a flashpoint: together Mars and Kellanova would command almost 28% of that market. “Shoppers already suffer high prices and fewer choices – this merger would only make it worse,” warns Amanda Starbuck of Food & Water Watch.

Still, experts say the deal likely clears with concessions — Mars may have to shed a brand or promise fair play on shelves to appease Brussels. Mars-Kellanova could be a bellwether for big consumer deals worldwide. If this $36 billion combo passes muster, other mega-mergers might be back on the menu.

After years of corporate dieting, Big Food is bulking up again—chasing growth via M&A as eating habits shift and store brands nibble at market share. Kellanova was spun off just last year; its quick sale shows how break-ups can lead to big makeups. The takeaway for closers: scale and diversification are king again. Watch for the EU’s verdict on June 25 and any concessions Mars must swallow to seal the deal.

Quick Hits ⚡

Blackstone Buys TXNM Energy for $11.5B

Acquires utility assets across Texas and New Mexico.

So what? Big vote of confidence in stable, regulated energy plays.

🔗 Source – Reuters

Lendlease Sells 6 UK Projects to Crown Estate

Cuts London exposure, exits Silvertown Quays.

So what? Focus shift back to Aussie heartland.

🔗 Source – The Australian

L&G Buys Real Estate Firm Proprium

Grabs 75% stake to expand private markets push.

So what? Strengthens global reach in alternative assets.

🔗 Source – Financial News London

Charter to Acquire Cox for $34.5B

US cable giants merge to scale broadband & streaming.

So what? Raises consolidation questions in telecom.

🔗 Source – Times of India

Greencore Buys Bakkavor for $1.6B

Unites major UK food suppliers.

So what? Strengthens grip on supermarket-ready meals.

🔗 Source – Reuters

Negotiation Nugget

Use the "Door-in-the-Face" Technique

Start with an exaggerated ask you don’t expect to land—then pivot to what you really want. This classic compliance strategy works because it triggers a sense of reciprocity: your concession (shrinking the ask) makes them more likely to concede in return (saying yes). Cialdini (1981) showed it could more than double agreement rates. Example: ask for a 3-year exclusivity, then “settle” for 12 months. Works best in face-to-face or high-trust deal dynamics where the contrast feels sincere, not manipulative.

Try anchoring with a bold ask first. 🔗 More on the technique

Micro-Chart 📈

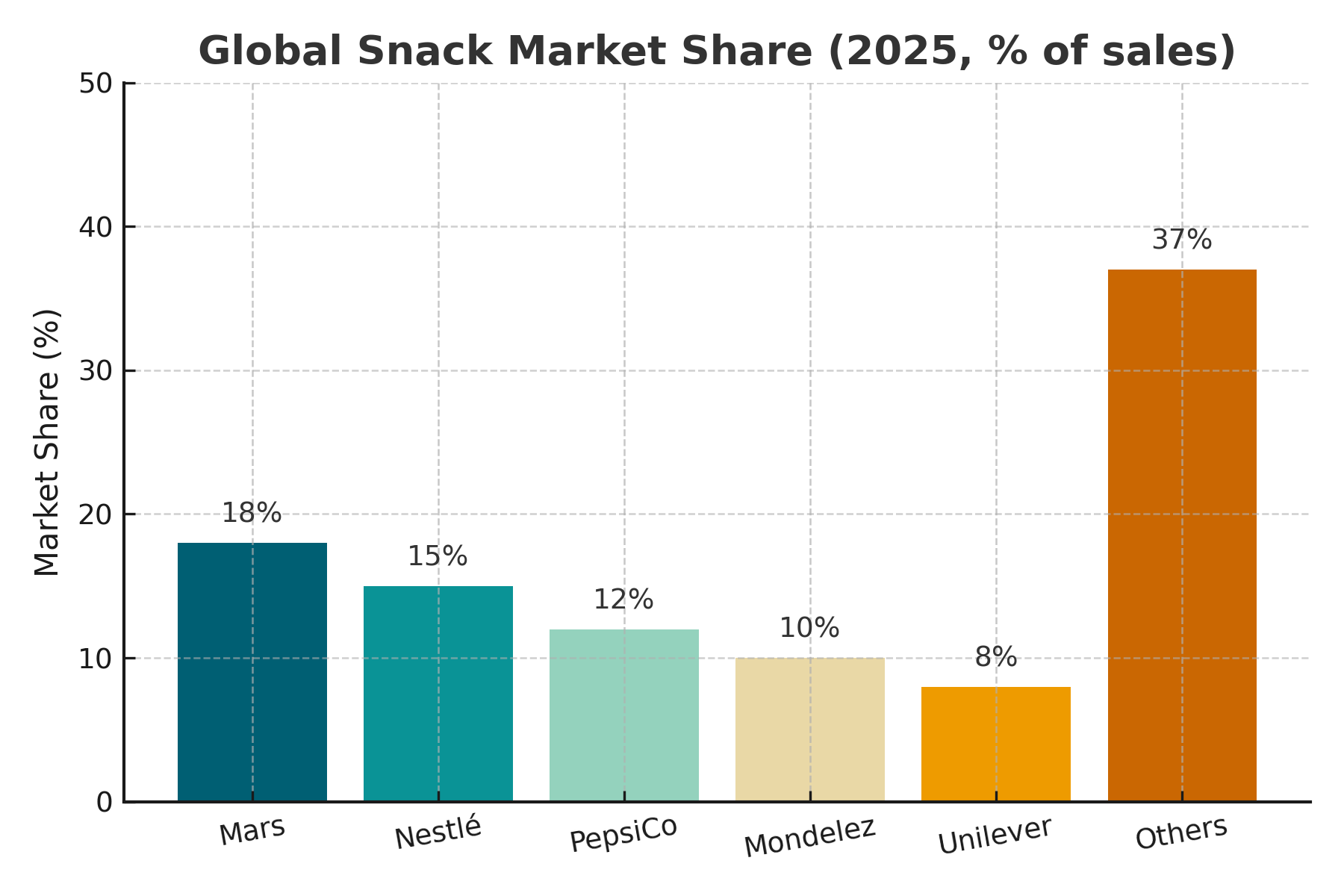

Global Snack Market Share (2025, % of sales)

Takeaway: If cleared, Mars’ Kellanova deal would boost it to #1—raising pressure on Nestlé and Mondelez.

Open Thread 🤔

Will Mars’ megadeal spark a global snack arms race?

Reply and tell us where you’d bet your biscuits.

Or get in touch here.