Good afternoon! Yes, it’s been a while—but The Closer is back, and we've got some exciting things planned for the months (and years) ahead. More on that soon.

In the meantime, we're rebooting this newsletter with one goal: to deliver the most compelling stories from the dealmaking world, paired with practical wisdom you can actually use. Whether you’re negotiating a billion-dollar acquisition or simply navigating life's daily negotiations—sales pitches, persuasion battles, tricky conversations—we're here to help sharpen your skills and insights.

We’d love your feedback to make The Closer as useful (and entertaining) as possible. Let's dive in.

Spotlight: Databricks Buys Neon for $1B – A Quiet Power Move in AI Infrastructure

This week, Databricks dropped a billion dollars on Neon, a startup building cloud-native Postgres databases that increasingly manage themselves. It didn’t make front-page headlines—but it probably should have.

Here’s why it matters: Neon isn’t just a database company. It’s a signal. The deal shows that the future of infrastructure isn’t just about speed or scale—it’s about autonomy. Neon claims that 80% of its databases are now created by AI, not humans. That stat alone should make CIOs and devs either excited or nervous.

For Databricks, this is more than a technical upgrade. It's a vertical consolidation of the AI stack—owning not just the compute and analytics layer, but the data layer itself. In a world where models are increasingly commoditized, owning the clean, structured, constantly-refreshing data pipeline is where the real moat lives.

And let’s not overlook the vibe: while Big Tech gets bogged down in regulatory molasses, Databricks is executing at speed. It's the kind of deal that feels small now but will look massive in hindsight if AI-native database infra becomes the new standard.

The takeaway? The next wave of dealmaking may not come from the giants trying to buy their way into relevance—but from the mid-tier titans quietly building tomorrow’s foundation, one unsexy but essential piece at a time.

Playbook: Lessons from Big Deals

1. Flexibility in Deal Structuring Is Crucial – In April 2025, Silver Lake Partners acquired a majority stake in Intel's Altera unit for $4.46 billion. To navigate market uncertainties, the deal included deferred payments, with $1 billion postponed to enhance internal return metrics. This approach underscores the importance of adaptable deal structures in volatile environments.

2. Market Timing and Regulatory Awareness Are Key – The announcement of U.S. tariffs in May 2025 led to a significant drop in M&A activity, with only 555 deals signed—the lowest since May 2009. This scenario highlights the necessity for dealmakers to be attuned to geopolitical developments and regulatory shifts that can impact transaction feasibility.

3. Diversification Strategies Can Mirror Successful Models – Bill Ackman's plan to transform Howard Hughes Holdings into a diversified holding company akin to Berkshire Hathaway illustrates a strategic move to emulate proven business models. While ambitious, such transformations require careful consideration of structural differences and market conditions to ensure success. Financial Times

4. Leveraging AI in Core Operations Enhances Efficiency Neon's claim that 80% of its databases are created by AI agents signifies a shift towards automation in core business functions. Companies integrating AI into their operations can achieve greater efficiency and scalability, a trend that's becoming increasingly prevalent in tech-driven industries.

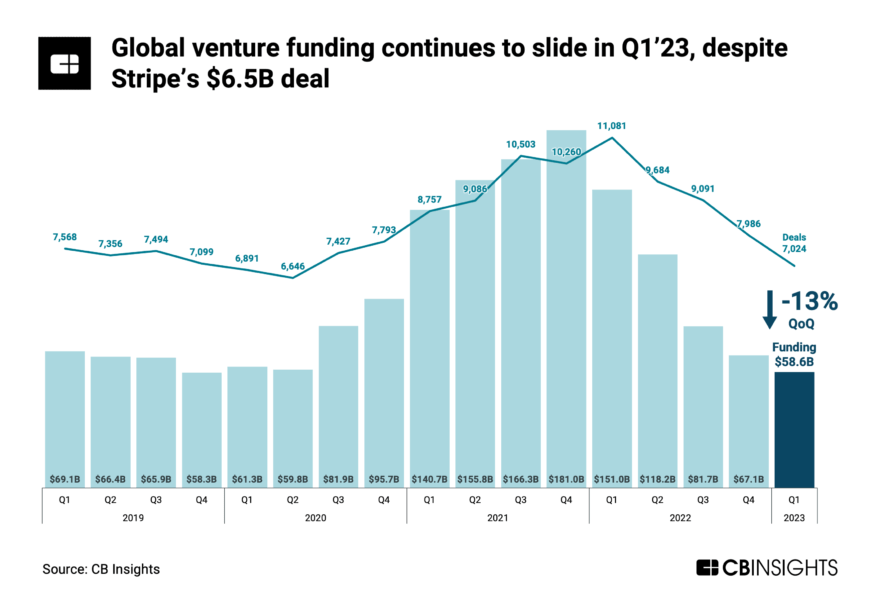

Chart: AI Funding Towers Over All

As the chart shows, investors have been throwing money at AI like it’s the last bus out of town. In Q1, AI startups attracted $59.6 billion – over half of all venture funding. The next largest sector (health/biotech) pulled in just $18 billion, and #3 (financial services) about $11 billion. In fact, a single deal – OpenAI’s record $40 B round at a $300 B valuation– made up one-third of the global total. Take that out, and funding would’ve been flat.

The takeaway? The AI frenzy continues, concentrating capital on a few juggernauts. One thing we're seeing is every company somehow pretending they are powered by AI, but 2025 is the year that AI becomes just like electricity. It's no longer a defining characteristic. It's a given.

Ode to John Brooks: Timeless Deal Wisdom

Most business writing ages, but John Brooks’ storytelling stays fresh. His classic “Business Adventures” (a Bill Gates and Warren Buffett favorite) chronicles fiascos and triumphs from the 1960s – yet the human quirks and boardroom dramas feel eerily familiar to today’s dealmakers. Brooks had a gift for exposing the gap between corporate ideals and real-world outcomes, often with a sly wink of humor. Whether it’s the over-engineered failure of the Ford Edsel or the communication breakdowns in a GE price-fixing scandal, Brooks reminds us that technology and markets change, but people (and their egos) don’t.

One gem from Business Adventures comes via Xerox founder Joseph Wilson, highlighting the eternal tension between lofty vision and cold hard numbers:

To set high goals, to have almost unattainable aspirations, to imbue people with the belief that they can be achieved—these are as important as the balance sheet, perhaps more so.

Modern dealmakers would do well to heed that line. In an era of spreadsheet analysis and algorithmic forecasts, Brooks (through Wilson) nudges us to remember the power of ambition and inspiration. Great deals aren’t just calculated – they’re also imagined. As we chase the next big venture or acquisition, Brooks’ work is a warm reminder: behind every term sheet and P&L statement, business is ultimately a very human adventure.

Or like we like to say at The Closer: Business is one of the greatest stages on earth. It's where the future is forged and where flawed, ambitious people clash and betray, build and accelerate with all the plot and character of a Shakespearean play.

Career Corner – Keeping Cool in the Room

When it comes to negotiation, consider this evergreen advice from publishing magnate Felix Dennis:

“Never fall in love with a deal. A deal is just a deal. There will always be other deals and other opportunities. No deal is a must-do deal… If it is, you are at the mercy of the party sitting across the table.”

If you read this far, we want to hear from you. We want The Closer to be an exciting and important part of your week – as a newsletter, as a podcast, but even beyond that. Ideas? Please get in touch or schedule a meeting with Bradley here.